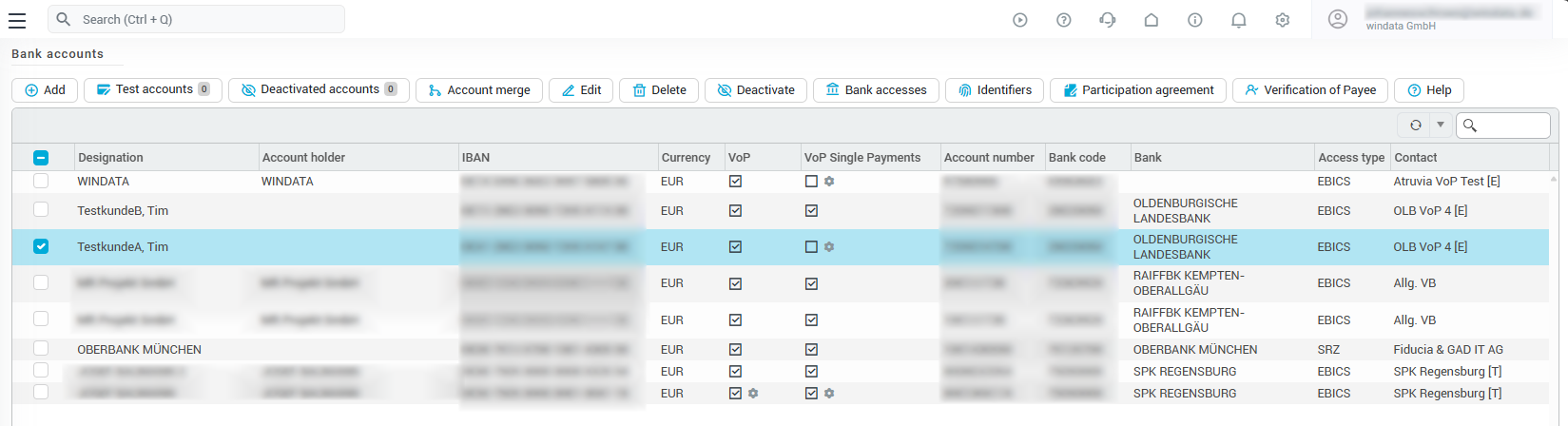

Bank accounts

Here you can manage all bank accounts that belong to your client - these are all the bank accounts for which you can create payments and retrieve transactions. You can also manage how individual accounts communicate with the bank here.

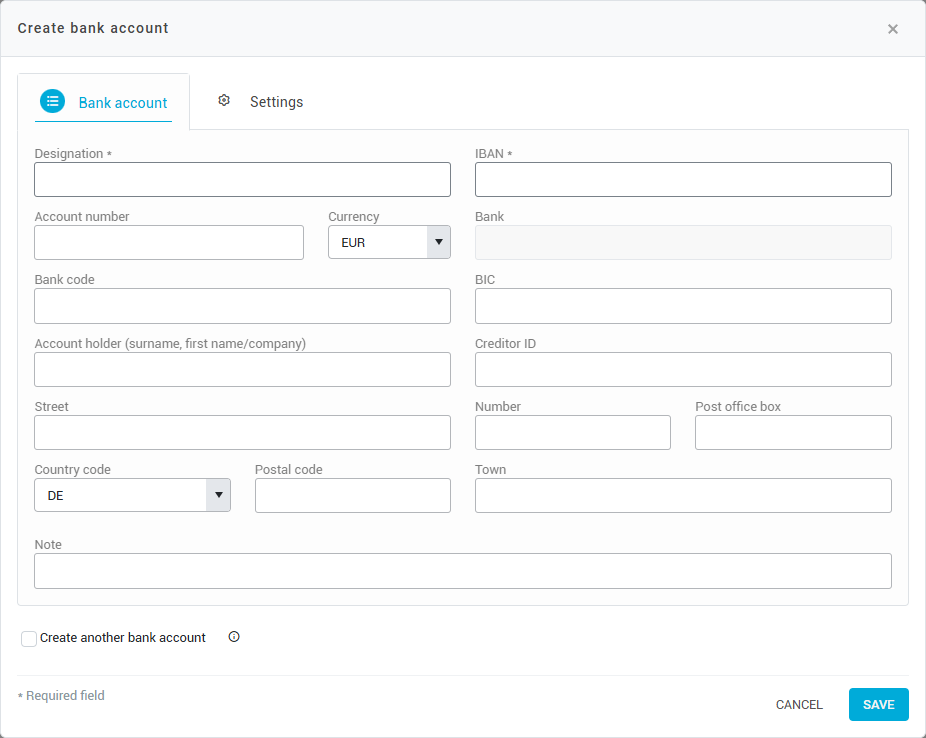

Add bank account

If you want to create payments for a bank account in konfipay, you must first create this account. There are the following options for creating a bank account:

Manual creation

At the top of the toolbar, click on Add. IBAN and Designation are mandatory fields. If only an account number and no IBAN is available, enter the account number in the IBAN field instead. When saving, konfipay will display a corresponding message, but the information will be saved nonetheless. To make international payments, it is recommended that you also enter your name and address.

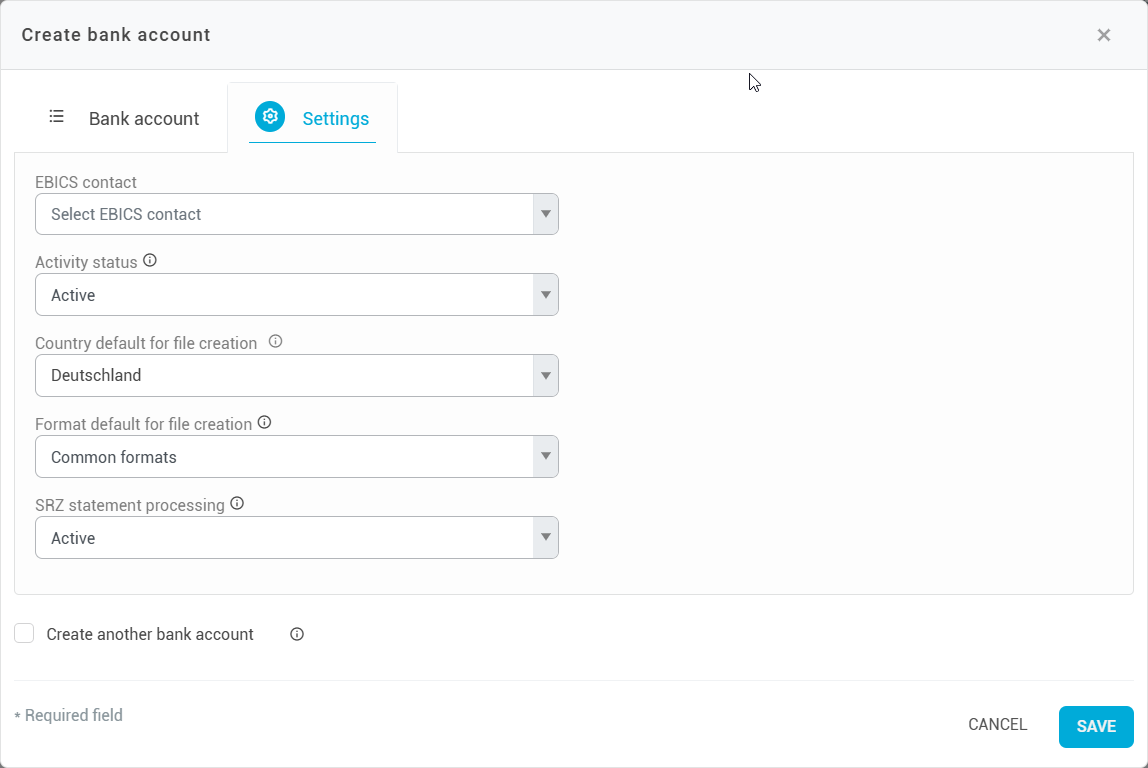

If you use multiple EBICS contacts, you can select in the “Settings“ tab under EBICS contact at the bottom to define which EBICS contact should be used for communicating with the bank regarding the account. If you have only one EBICS account or intend to use the account only via SRZ, you can leave this field blank.

Tab “Bank account”

Tab “Settings”

Creation via EBICS account list

Some banks transfer account data when an EBICS contact is set up automatically, They transfer a list of associated bank accounts, which konfipay is able to read and to use in order to create the corresponding bank accounts automatically. This means that you may not have to create your bank accounts manually when setting up konfipay.

The account list is also retrieved automatically at set intervals so that bank accounts that are added after the EBICS contact has been set up, are also created in konfipay without the need for manual entry.

Creation via API

Bank accounts can also be managed by external applications via the konfipay API. Further information on creating bank accounts via the API can be found in the API documentation.

Creation on payment submission

In the API settings under the tab Actions, the setting Automatic setup of bank accounts can be activated. This means that when a payment is submitted, the associated bank account is automatically created in konfipay if it does not already exist. This means that a bank account will be created automatically if a payment for said account is submitted via API.

Country default for file creation

Depending on the country in which the account-holding bank is located, different guidelines apply for payment transaction files. The country default for file creation setting can be used to specify which country default is to be used to create the payment transaction file for this account. It is not usually necessary to change this value manually. When setting up a bank account, konfipay automatically determines the country setting based on the two-digit ISO country code of the IBAN.

Format default for file creation

This setting controls which formats are used when creating payment transaction files. Common formats are recommended here by default. Only change the setting to Latest formats in consultation with your konfipay customer advisor or your bank advisor.

Generate account statement files - MT940 from camt.053

Activate this setting to automatically create MT940 files based on the camt.053 files provided by the bank. The MT940 files created are automatically assigned to your database and can be viewed, downloaded, or accessed via the konfipay API as transaction files.

The generated MT940 file does not officially come from your bank. We generate the files based on the MT940 standard, but do not guarantee that the file format is fully compatible with your system landscape.

SRZ statement processing

By participating in the SRZ procedure, account transactions are provided, depending on the agreement. If this is no longer desired (e.g. because the account transactions are retrieved via another access such as EBICS), the processing of transactions provided via SRZ can be deactivated via this option. This option takes effect immediately after saving, but has no effect on existing account transactions - these are retained. Deactivating the processing in konfipay is therefore generally much quicker and easier than revoking the provision at the service data center. Nevertheless, it is recommended to revoke the provision if this is no longer desired. If the revocation is not made, konfipay will no longer process the files, but they will still be provided by the service data center.

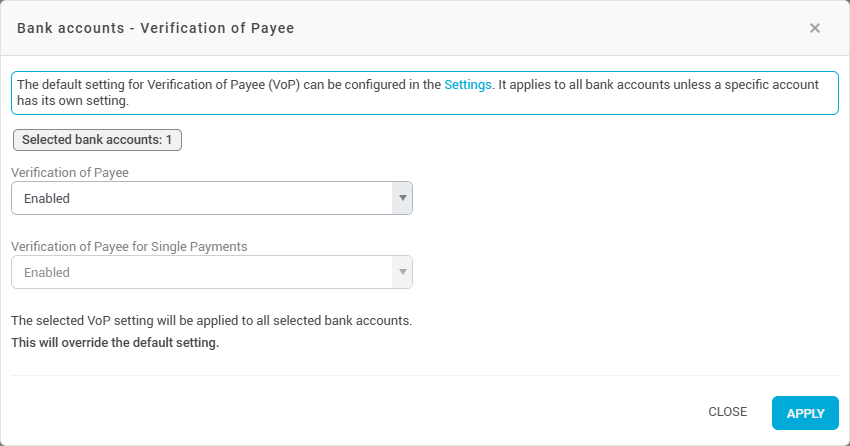

Settings for Verification of Payee (VOP)

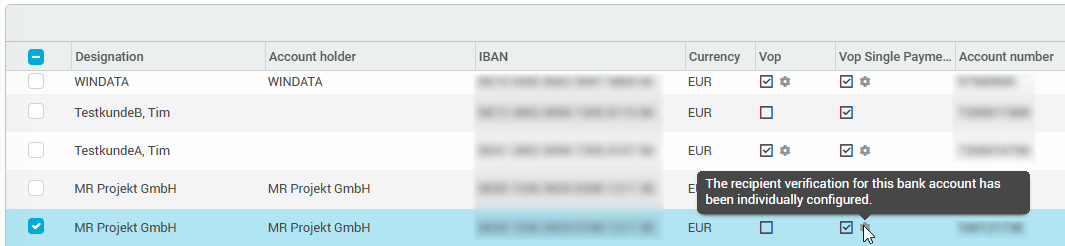

Verification of Payee (VOP) can be controlled individually for each bank account. VOP can be enabled or disabled for bulk payments and single payments for each account. By default, the preferences for VOP stored under Settings apply to all bank accounts.

To change the VOP settings for a single bank account (or a group of bank accounts), select the relevant accounts from the list. Then click Verification of Payee at the top of the toolbar.

You can then enable or disable VOP in general on the left. On the right, you can enable or disable VOP for single payments. If VOP is enabled in general, then VOP is always automatically enabled for single payments.

In the bank account overview, you can see for each account individually whether VOP is currently enabled in general and for single payments. If the setting has been made individually at account level, this is indicated here with the gear icon.

In the activity log, you will find comprehensive documentation of which user changed this setting for which bank account, when, and how.

Deactivate bank account

You have the option of completely deactivating bank accounts for your client. No more account transactions will then be processed for deactivated bank accounts and no payment files can be submitted. Deactivated bank accounts are hidden in all views - however, existing data linked to deactivated accounts (i.e. account transactions or payment orders) is retained in full.

Deactivating bank accounts can be useful if you have several accounts with a bank but only want to use one of these accounts in konfipay. These accounts would always be created automatically as your client's bank accounts due to the automated retrieval of the account list - by deactivating them, you can prevent this and only work with the accounts you want to work with in konfipay.

To deactivate a bank account, simply select the account in the list and click on Deactivate. You will then find deactivated accounts under the item Deactivated accounts in the toolbar - you can also reactivate the accounts there if required.

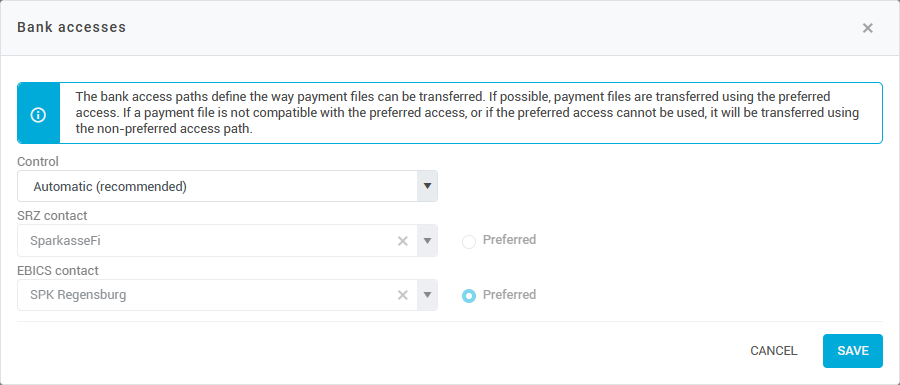

Manage bank communcation

Once an account has been created, konfipay automatically determines the method of bank access via which the account is connected to the bank and communication with the bank takes place. If required, you can manually set which bank access should be used to access the bank account for automated payment submissions (via API). To do this, select the desired account in the list of accounts and click on Bank accesses.

At Control, first select the option Manual - this overrides the setting chosen by konfipay. You can then set the two fields SRZ contact and EBICS contact accordingly and select a different access, if necessary.

Set a preferred access by marking either the EBICS or the SRZ contact as preferred on the right. Only if no transfer is possible with the preferred access, will konfipay switch to the non-preferred alternative. A detailed explanation of the differences between SRZ and EBICS can be found in this article. You can find instructions on how to set up a bank account with bank access via SRZ here.

Please note that these settings only affect the automated payment submission (via API). To change the available EBICS contacts for manual payment submission, please use the bank account setting in the EBICS contact administration section.

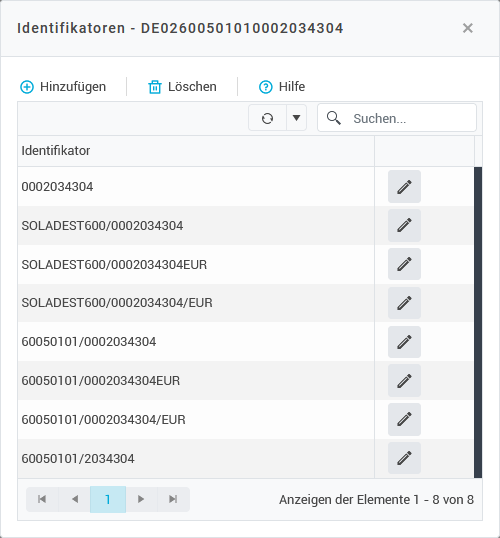

Account identifiers

To automatically assign account transactions to an account, konfipay generally uses the IBAN in the transaction files. However, if this is not specified in the transactions or is incomplete, konfipay falls back on the identifiers defined here.

Identifiers consist, for example, of a combination of account number, bank code, BIC and currency of the account. If such an identifier is then found in a transaction file, the file can be assigned to the correct account.

Identifiers are automatically generated for some accounts when the account lists are retrieved via EBICS.

Examples of identifiers for a fictitious account

Tags

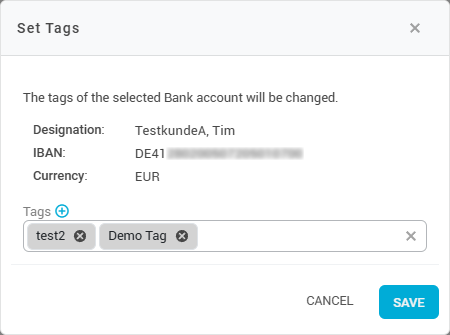

You can use tags to mark data in konfipay (e.g., bank accounts). This can be helpful for implementing efficient content restrictions, for example. To do this, select the bank account in the list for which you want to manage the tags and click on Tags at the top of the toolbar. You will then see the tags already assigned to this account.

Click in the Tags field to see all available tags. By clicking on the relevant tags, you can select which tags you want to assign to the account. You can also remove a tag from an account by clicking on the x icon next to the tag.

You can also create a new tag by clicking on the + icon. This opens the creation dialog, and you can assign the newly created tag directly to the account.

Manage konfipay test accounts

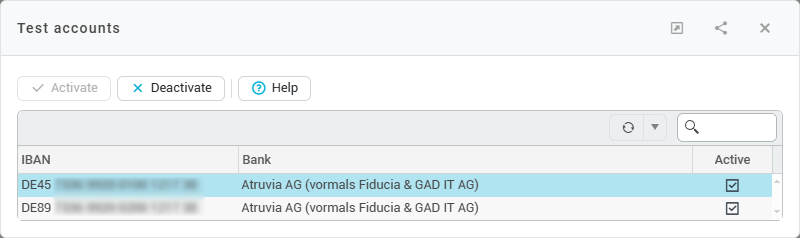

Several test accounts are provided in konfipay for testing purposes. These accounts generate daily test sales and can also be used to test payment submission. The submitted payments are not executed.

You can activate or deactivate these accounts by clicking on Test accounts, then selecting the desired account and clicking again in the top bar on Activate or Deactivate respectively.

For activated test accounts, for example, account transactions are then displayed and the activated accounts can be selected for payment transfers on a test basis.

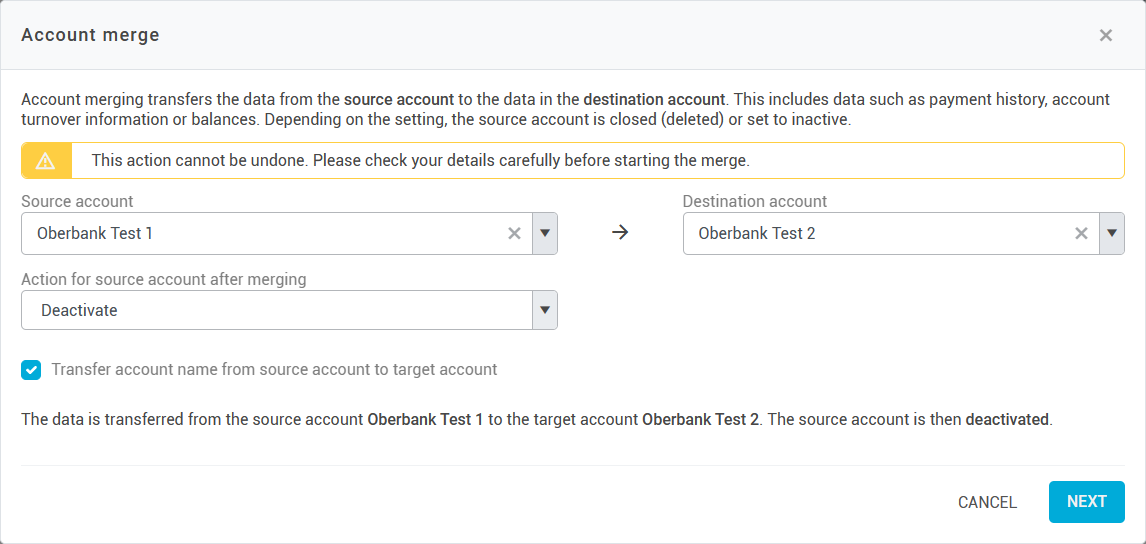

Account merge

If your bank merges with another bank, your bank account may continue to exist with a new IBAN or BIC. By automatically retrieving the account list, konfipay automatically creates the new account with the new connection information (new IBAN/BIC). In this case, the account is then kept in konfipay twice - once with the old information from before the bank merger, and once with the new information after the merger. When importing account transactions manually, it is also possible that konfipay will create a new bank account for the transactions instead of adding them to the existing account.

You can merge the two accounts to ensure that the data, e.g. account transactions, is retained without any break. This involves transferring the data (payment history, transactions, balances, etc.) from the old account to the new account.

To do this, click on Account merge at the top of the toolbar. On the left-hand side, select the Source account - i.e. the old account whose data is to be transferred to the new account. On the right, under Target account, select the new account to which the data is to be transferred. In the next line, specify what should happen to the old account (source account) after the merge - the source account can be deactivated or completely deleted.

An account merge cannot be undone. Please check your details carefully before you start the merger.