Settings

Here you will find options for using konfipay. The settings are divided into verifications and actions. Verifications are used to check submitted files and report any errors. Actions change data automatically and can be used to correct errors in submitted files.

Verifications

The verifications are used to detect syntactical and/or logical errors as early as possible in payment processing. As different banks have different levels of tolerance towards errors, you can activate or deactivate each check individually in order to adapt it to your bank's verification criteria.

The following table describes the individual tests in detail:

Verification | Description |

|---|---|

SEPA participating country | Check whether the IBAN of the other party to the credit transfer or direct debit belongs to a SEPA participant country. Only applies to payment formats that are subject to the SEPA country restriction. |

IBAN validation | Validation of the IBAN by calculating and comparing the check digit. |

IBAN/BIC affiliation | Check that IBAN and BIC belong together. |

XML schema validation | Validation of the submitted files against the referenced XML schema. |

RDT character set check | Checking the files against the character set permitted in the DFÜ agreement. During this check, you can choose between the "Standard character set" and the "Extended character set". Only applies to files that are subject to the DFÜ character set restriction. |

EPC/DK rules | Examination according to restrictions and rules of the European Payment Council (EPC) and the German Banking Industry (Deutsche Kreditwirtschaft, DK). |

Checking the control values | Verification of the number of payments specified in the file and the checksum total against the actual values. |

AZV file check | Checking the structure and content of international transfers in DTAZV format. |

Double submission | Check whether the same file has already been submitted within a defined period of time. The time period can be set individually (1 to 48 hours). |

Address verification for direct debits outside the EU | Check whether the debitor's address is included in the direct debit. If the debtor's account-holding bank is located outside the EU, the address must be provided. |

Checking the EBICS order type | Check whether the EBICS contact used to execute a payment has the necessary order type. |

Execution date | Checking the execution date for submitted payment orders. The execution date must not be in the past. |

Creditor identification number | Verification of the creditor identification number for submitted payment orders. |

Unique message ID | Check for uniqueness of the message ID. |

Creation of offline accounts | If the setting is active, the creation of offline accounts via the API is permitted. If the setting is deactivated, the creation of offline accounts via the API is rejected. Offline accounts are neither linked to an EBICS access nor connected to a service data center, so that no online action is possible. |

Verification of Payee (VOP) | When VOP (Verification of Payee) is active, the names of payees are compared with the names actually stored at the recipient bank. Deactivating this function significantly increases the risk of fraud. |

Verification of Payee (VOP) for single payments | Enables or disables VOP for single payments. By default, VOP is mandatory for single payments. This setting should only be disabled after consulting your bank. If VOP is enabled in general (see setting above), then VOP is always enabled for single payments. |

If you disable Verification of Payee (VOP), you will be asked to explicitly confirm this action. This is because VOP provides protection against fraud and its deactivation must be documented. Logs for activating or deactivating VOP can be found in the activity log.

Actions

The actions automatically intervene in the transferred files or in the database of konfipay if certain conditions are met. The actions can help to optimize workflows or automatically correct errors in the transferred data.

The actions are deactivated by default and must be actively selected by the user. The following table describes the individual actions in detail:

Action | Description |

|---|---|

Conversion of non-permitted characters | Automatic conversion of non-permitted characters (in accordance with the DFÜ agreement) for SEPA payments. The conversion is done according to the EPC SEPA Conversion Table, and works in konfipay according to the conversion table that you can find at the bottom of this page. |

Create bank accounts automatically | Automatic creation of bank accounts from payment transaction files submitted via API. |

Conversion from COR1 to CORE | COR1 is no longer supported as a direct debit type. |

Formatting bank-specific XML files | Bank-specific XML files are output in formatted form (line breaks and indentations). |

XML declaration in banking XML files | The XML declaration <?xml version='1.0' encoding='utf-8' ?> is placed in front of bank-specific XML files. |

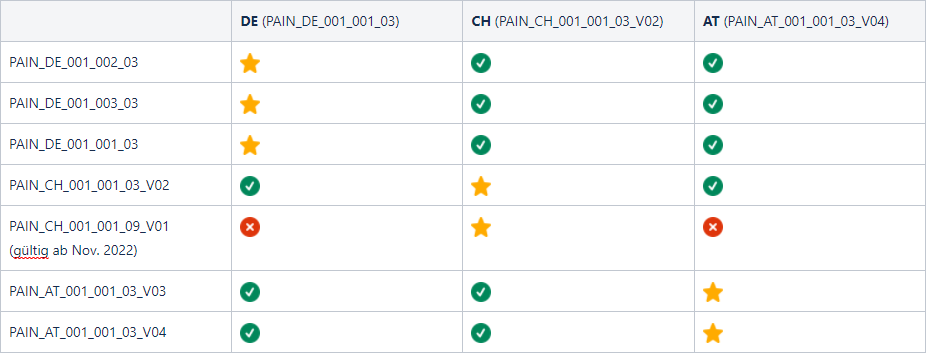

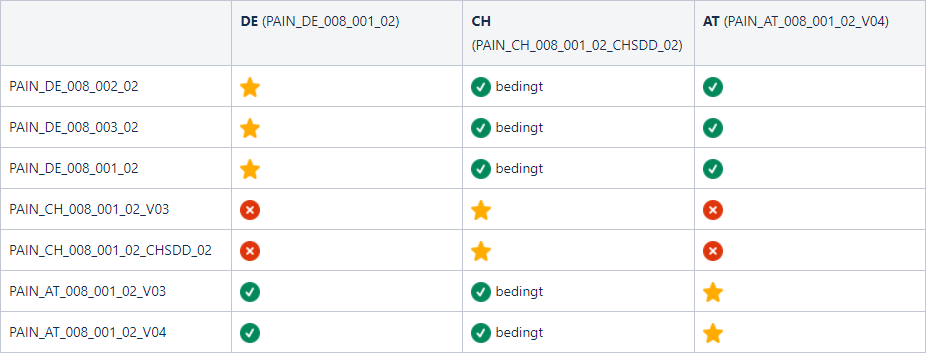

Conversion of outdated payment order files | Payment order files in SEPA pain format are automatically upgraded to a current version. The conversion only takes place for versions that are no longer valid according to the RDT agreement, according to the following scheme:

|

Asynchronous file processing | Payment transaction files are processed asynchronously after submission. Recommended for large files (>2 MB). |

Conversion of payment order files into country-specific formats | Automatic conversion of submitted SEPA payments into the country-specific target format. The target format depends on the ISO country code of the respective EBICS contact. Note: Due to content restrictions, conversion is not possible in all cases. Possible conversions can be found in the following tables: Legend 💛 Conversion is not intended. The original document is returned. ❌ Conversion is not possible (unknown pain formats or serious differences in source and target XSD scheme). ✅ Conversion is possible: errors may occur depending on the assignment of the fields. Transfers  Direct debits  |

Conversion of urgent payments to instant payments | Submitted urgent payments are automatically converted to instant payments for even faster transfers. When activating this, make sure that your bank offers instant payments. The amount limit defines the transfer amount up to which urgent payments are converted to instant payments. If the amount limit is exceeded, the payment will be rejected upon submission with a corresponding error message. |

Conversion table of non-permitted characters

Non-permitted character | Converts to |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|