Verification of Payee (VoP) - konfipay (EN)

General

Introduction

Verification of Payee (VoP) is a legally regulated procedure introduced by EU Regulation 2024/886. It is designed to prevent incorrect transfers and payment fraud by comparing the recipient data entered by the payer with the legitimate master data of the recipient bank.

From October 5, 2025, Verification of Payee will be mandatory for all SEPA transfers and SEPA real-time transfers within the European Economic Area.

Purpose and functionality

The aim is to protect the payer and improve payment security. When a transfer is submitted via opt-in, the recipient bank compares the IBAN and the legitimate recipient name. The result can be:

✅ Match – Name and IBAN match

⚠️ Close match – Name almost matches (payer receives actual name)

❌ No match – No match possible

⛔ Not possible – No check can be performed from a technical standpoint

The payer decides whether to authorize the payment based on the verification result.

Implementation in konfipay

konfipay supports VoP in both the SEPA standard transfer format (pain.001) and real-time payment transactions.

→ As a konfipay user, you can disable VoP either globally for your whole client or at bank account level.

You can find a tutorial on the client-wide opt-out here: https://ior.ad/aXZa

The opt-out procedure at bank account level is explained here: https://ior.ad/aZB6

API

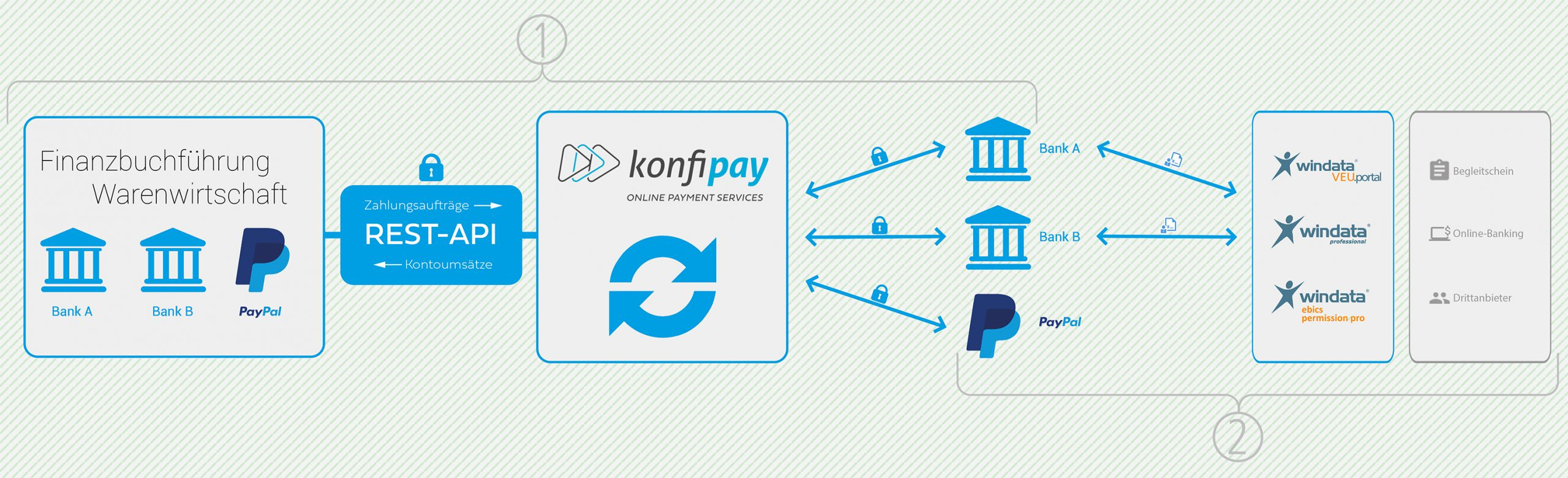

All existing API integrations can continue to be used unchanged. All regulatory changes are intercepted by konfipay and compensated for in appropriate workflows.

There will also be new API endpoints to map the topic of VoP in a user-friendly way in the respective ERP/financial accounting software in conjunction with the VEU. We are currently working on this and will publish the new endpoints in the API documentation as soon as possible: https://portal.konfipay.de/api-docs/index.html

EBICS

Opt-in (with VoP check)

Payments with opt-in checks are automatically placed in the VEU. We recommend using the appropriate konfipaySign app to approve payments.

Opt-out (without VoP check)

Possible for payment files with multiple transactions; individual transactions can also be submitted via opt-out at most credit institutions.

Service center (SRZ)

Opt-in (with VoP check)

Payments with opt-in verification are automatically placed in the VEU. We recommend using the appropriate konfipaySign app for payment approval.

Impact on your processes:

With opt-in, it is mandatory for the end customer to review the verification result and provide electronic approval – konfipaySign offers this option.

The VoP check result (VPZ) is made available exclusively to the person approving the payments; the service data center has no access to this check result.

Opt-out (without VoP check)

Possible for payment files with multiple transactions; individual transactions can also be submitted via opt-out at most credit institutions.

Impact on your processes

Match results can make payment immediately authorizable

Close/No Match requires manual review or adjustment

VEU or TAN approval becomes an integral part of authorization (depending on the channel):

Standardized process for downstream payment approval in konfipay:

Step 1: Payments can be transferred to konfipay via API - alternatively, payment files can be uploaded to the konfipay portal or entered manually.

Step 2: Payment approval takes place downstream using the VEU process.

Recommended actions

Opt-out option:

✅ If you would like to continue processing payments as before without any additional intermediate steps, apply to your bank for the opt-out procedure for VoP. In addition, there will be an option in konfipay to activate the opt-out procedure in general. Check with your bank to see if files with only one payment can also be submitted with opt-out.

Opt-in option:

🔁 Activate verification for unique message ID; this is the only way to assign the VOP result.

🛠️ Adjust processes: Implement konfipaySign as a multi-bank payment approval procedure.

Download konfipaySign app

Regulatory basis

The legal obligation to verify recipients arises from EU Regulation 2024/886 (“Instant Payments Regulation”). This obliges payment service providers in the EU to provide VoP for all SEPA credit transfers and SEPA instant payments.

The key requirements at a glance:

⏱️ The VoP check must be performed within five seconds.

🕒 Availability must be guaranteed 24/7/365.

💶 The service must be free of charge for the payer.

🔁 VoP must work across all channels through which transfers can be submitted (e.g., EBICS, FinTS/HBCI, online banking, API)

These requirements are intended to increase the security of payment transactions – regardless of channel, bank, or time of day.

Distinction from payments not subject to the VoP

The VoP obligation applies exclusively to:

SEPA credit transfers (SCT)

SEPA real-time credit transfers (SCT Inst)

The following are not covered by the VoP regulation:

❌ Euro express transfers (e.g., via SWIFT/CCU)

❌ SWIFT international payments (e.g., MT103)

❌ SEPA direct debits (SDD)

These exceptions are confirmed in the banks' official FAQs. Voluntary implementation of checks—e.g., in H2H or SWIFT scenarios using master data reconciliation or account validation—is technically possible but not required by regulation.

Payment type | Subject to VoP from 5 October 2025? |

|---|---|

SEPA credit transfer (SCT) | ✅ Yes |

SEPA real-time credit transfer | ✅ Yes |

Euro express transfer (e.g., SWIFT) | ❌ No |

SWIFT international payment | ❌ No |

SEPA direct debit | ❌ No |

Version history and publication

The final specification for VoP integration in EBICS and FinTS was published on June 27, 2025. It defines the supported business transactions (e.g. CTV/CIV for EBICS and HKVPP/HKVPA for FinTS), feedback formats (e.g. pain.002 and VPZ), and the technical and regulatory framework for compliant implementation of recipient verification in payment transactions. This specification is considered a binding basis for all payment service providers and software providers with VoP-relevant submission channels.

⚠️ Due to the late publication date, there is a very narrow time window until the mandatory introduction on October 5, 2025. This puts credit institutions and software providers under considerable implementation pressure. As a result, many details could not be communicated at an early stage, which in turn has an impact on planning, testing, and customer preparations.

Conclusion

As things stand, VoP will become an integral part of payment transactions on October 5, 2025. This offers companies the opportunity to make payments more secure – however, technical and organizational preparations are necessary. Its integration into EBICS and FinTS makes VoP relevant for almost all corporate customer channels. Payments outside SEPA, such as via SWIFT or direct debit, are not affected, but can be optionally secured by additional verification mechanisms.